What the anti-fraud plan and the government's productivist turn concretely change for businesses.

The start of 2025 marks a clear turning point in French economic policy: between the intensive fight against fraud and the desire to reindustrialize the country, business leaders, start-ups, and project holders will have to navigate an increasingly structured – even constraining – environment.

The government plans to combine increased control, industrial relocation, and budgetary rigor, hoping to restore competitiveness to our economy. In this context, it becomes essential to anticipate upcoming legal and tax obligations, but also to leverage them intelligently.

At PRAX Avocats, a specialist in legal advice for businesses and start-ups, we offer a clear analysis of these major developments.

An economic context that brings new priorities to the forefront

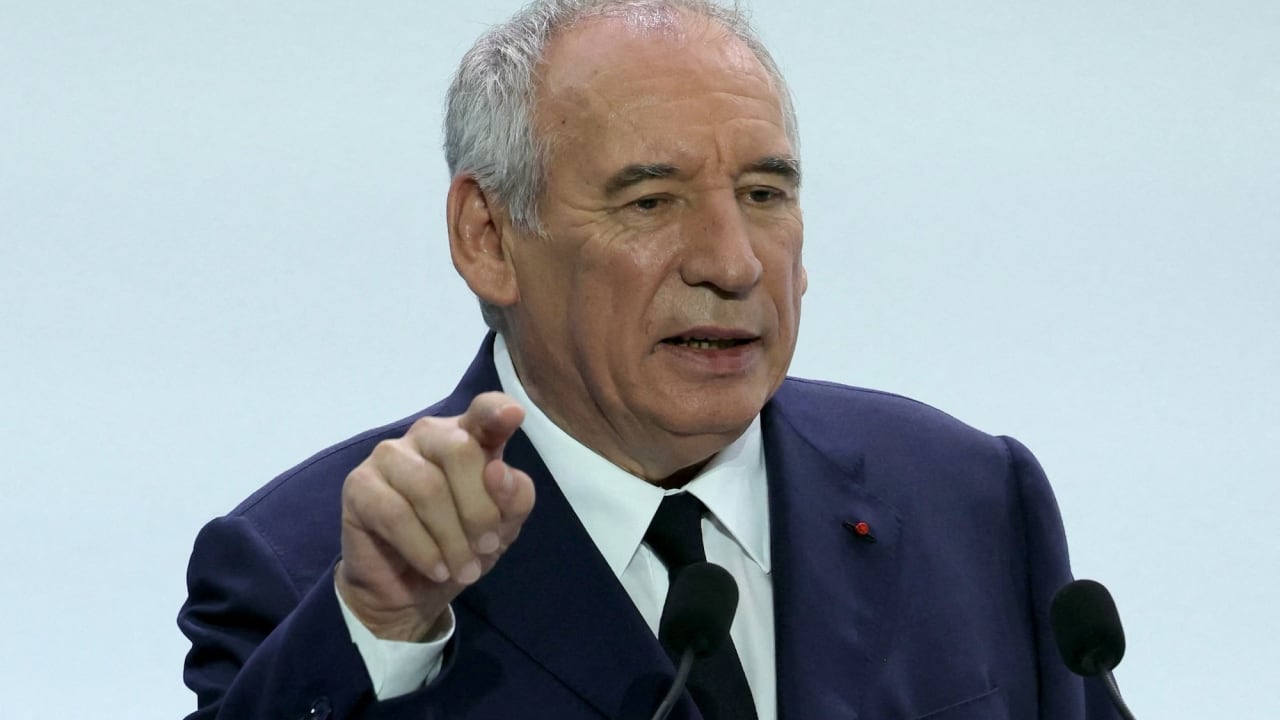

The announcement of the Bayrou Plan in mid-July 2025 is part of a strategic repositioning of French economic policy. The focus is no longer on supporting consumption, but clearly on redirecting efforts towards production. The state wants to strengthen the national industry, secure supply chains, reduce international dependence, and revitalize territories.

At the same time, the government has announced a significant budgetary effort – nearly 44 billion euros more in 2026 – to enhance the fight against fraud. A bill will be submitted as early as autumn, featuring unprecedented measures.

This dual approach – competitiveness on one side, strengthened fiscal and social control on the other – disrupts the balance for many business leaders.

It is no longer sufficient to remain compliant with regulations: for certain sectors (tech, transport, care-related services, freelancing...), deep adaptation is required.

Anti-fraud plan: towards total transparency for companies and beneficiaries

The announced anti-fraud bill contains very concrete measures that will have a significant impact on businesses, even those perfectly compliant. Let’s examine them in detail.

Extended access to asset data

One of the most striking provisions is the new access that social security funds will have to the entire assets of beneficiaries to detect any undeclared income.

➡️ This opens the door to a potential expansion of the interconnection of tax and social files: bank accounts, assets held abroad, and intermediary companies could be more easily scrutinized.

For start-up leaders or entrepreneurs who are both beneficiaries of social benefits (ARE, ACRE, etc.) and holders of stakes in legal entities (holding, SAS, etc.), this increased transparency requires great rigor in their legal structuring and remuneration strategy.

Legal business support becomes essential to prevent certain optimizations from being reclassified as abusive arrangements.

Preventive blocking of bank accounts: maximum vigilance

Another important novelty: companies suspected of concealed work could see their bank accounts conservatively blocked during the control period. The goal? To prevent funds from being moved or liquidated in order to organize their "judicial insolvency."

Even in the absence of fraudulent intent, this measure can cause real cash flow difficulties. Thus, for companies hiring freelancers, platforms, or foreign providers, the traceability of flows and the compliance of contractual relationships become crucial.

At PRAX Avocats, our expertise in labor law and contractual structuring can help you secure your practices to reduce your exposure to this risk.

Strengthening sanctions on illicit income

Finally, the government plans to apply an exceptional rate of 45% CSG (generalized social contribution) on "illicit income." This mechanism primarily targets traffickers, but its scope could be extended, particularly to certain tax abuses or poorly documented arrangements.

This calls for caution for all atypical operations aimed at asset management or optimization: stock options distributed outside the framework, agreements between related companies, disguised dividend distributions as expenses, etc. A regular review of your tax practices – with a business lawyer – becomes advisable.

A productivity shift with concrete implications for start-ups and SMEs

Alongside the tightening of controls, the state seeks to revive a strong industrial sector – including through tech start-ups.

Several measures can thus become real opportunities for innovative companies, provided they anticipate.

Relocating added value: a challenge for tech start-ups

The Bayrou Plan emphasizes the reconstruction of value chains on French soil. For young industrial or deep-tech companies, this can represent easier access to:

- Grants within the framework of sector strategies (medical, electronics, energy...) – provided local criteria are met;

- Public contracts prioritizing European players;

- Land or productive equipment through localized projects.

But this also requires rethinking how a start-up structures its supply chain, its legal establishments (in France or abroad), and the intellectual property of its innovations. The localization of rights (patents, software) can make all the difference in public project calls.

A company can only be perceived as a "national producer" if its legal and tax models clearly allow it.

A legal audit of your industrial establishment or intellectual property strategy, in advance, can save valuable time.

Preferential access to competitive energy for industry: the regulatory puzzle

An integral part of the plan, preferential access to energy tariffs for industrial players can also benefit certain digital and cloud actors – who are very energy-intensive – provided they are considered "producers."

This necessitates clarifying one’s status: can a start-up engaged in high-performance computing be seen as an "industrial" company in the fiscal sense? Qualification mechanisms exist – but they must be mobilized intelligently.

Well-informed legal business advice is crucial to leverage your activities in light of these advantages.

An imperative: secure your models to gain robustness

In this new context – both more incentivizing for producers and more punitive for fiscal and social breaches – entrepreneurs must adapt their legal governance.

Hybrid models, often used by start-ups (unpaid agents, freelancers without formal contracts, deferred compensation solutions via shares), can be effective as long as they are legally framed.

Some areas of vigilance:

- Secure HR practices: regarding the status of the leader, non-compete clauses, ownership of intellectual creations, etc.

- Update shareholder agreements to integrate a long-term vision compatible with the expectations of public or banking actors.

- Protect your assets (patents, trademarks, databases), which can play a key role in your qualification as a strategic innovative company.

At PRAX Avocats, we have supported numerous start-ups in structuring their models by integrating these dimensions into their growth strategy, even in an evolving legislative environment.

In conclusion: anticipate, structure, secure

The budgetary context of 2025-2026 pushes the state to concentrate its efforts around control and productive recovery. For businesses, this is both a constraint (more rigor and compliance) and an opportunity (better access to aid and the industrial ecosystem).

The key? Legally structure your model now, with a proactive and rigorous approach.

PRAX Avocats supports start-ups, SMEs, and project holders in this anticipation and securing process, with tailored advice crossing business law, tax law, labor law, and intellectual property.

For personalized legal support for your business project, contact PRAX Avocats.