Declaration of capital gains on securities: pay attention to box 3SG and the allowance to be reintegrated.

When selling securities (shares or stock in a company), the manager or founder of a startup may, under certain conditions, benefit from a holding period allowance on the taxable capital gain for income tax. But beware: this tax advantage does not apply to social contributions or the exceptional contribution on high incomes (CEHR). A common omission during the declaration can lead to heavy tax reassessments... unless the administration fails to demonstrate intent to commit fraud. A recent decision by the administrative court of appeal of Versailles conveniently reminds us of this.

This article aims to clearly and pedagogically explain this little-known issue, which has a significant fiscal impact, drawing lessons from the jurisprudence of May 26, 2025 (CAA Versailles, No. 22VE02754). We detail here the mechanisms, the consequences for entrepreneurs, and the points of vigilance to avoid any misunderstanding with the tax administration.

Understanding the Issue: Capital Gains, the Holding Period Allowance, and the Famous Box 3SG

What is at Stake: Taxation of Securities Transfers

The transfer of a company's securities, whether held by a founding manager or an individual investor, often generates a capital gain, which is subject to:

- Income tax (IR),

- Social contributions (PS, at a global rate of 17.2%),

- And, depending on the reference tax income (RFR), the exceptional contribution on high incomes (CEHR), at a rate of 3% or 4%.

In some cases, a holding period allowance applies to the capital gain taxable at the IR. It can go up to 85% when the securities are those of SMEs under 10 years old held for at least 8 years.

⚠️ This allowance only applies to income tax. It does NOT reduce the taxable base for social contributions or the CEHR. And this is precisely where declaration errors occur.

The Recurring Trap: Non-Reintegration of the Allowance for PS and CEHR

When declaring the capital gain, you must:

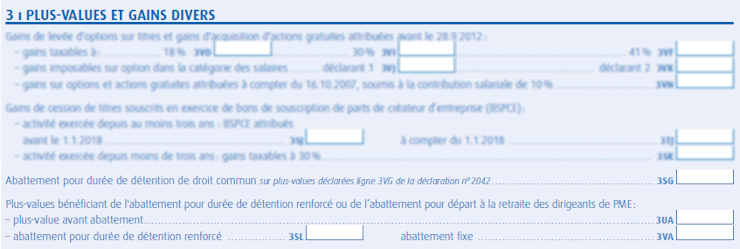

- Apply the allowance (if applicable) in box 3VG or 3SG for the net amount subject to IR,

- But also indicate, in box 3SG, the gross amount of the capital gain for the calculation of PS and CEHR (thus reintegrating the allowance previously applied in the calculation of IR).

An explanatory document is generally provided by your banking institution, in the form of a unique tax form (IFU). This document summarizes the amounts to declare and specifies the logic of reintegration.

Unfortunately, some taxpayers repeat an omission year after year: declaring only the capital gain after allowance (useful for IR), but without reverting to the complete calculation base for social contributions.

Result: an underestimation of the taxable base, and therefore of the tax owed for PS and CEHR.

A Key Decision: Towards a Finer Assessment of Deliberate Default

The case submitted to the administrative court of appeal of Versailles illustrates this situation well.

The Context of the Facts (CAA Versailles, May 26, 2025, No. 22VE02754)

The taxpayers had, in 2013 and 2014, correctly reported the amount of the allowance to be reintegrated in box 3SG. Their declarations were based on the annual summary and the tax notices provided by their bank. In 2015 and 2016, however, they omitted this reintegration operation.

The tax administration reassessed the taxpayers for more than one million euros, integrating the amounts omitted for PS and CEHR, and applied the maximum penalty: a 40% increase for deliberate default.

The taxpayers contested this sanction before the administrative jurisdiction.

The Decision: No Deliberate Default According to the Judges

The court ruled in their favor: it found that these errors – although significant in amounts – were not sufficient to characterize a deliberate intent to defraud.

Here are the main lessons from the ruling:

- The administration had all the elements: the taxpayers had sent a complete bank justification. The administration could therefore transparently calculate the amounts owed.

- The error had been made for two consecutive years, but without any control taking place in the meantime. It was therefore not a repeat offense, but a persistent misunderstanding of the rule.

- The taxpayers had never been subject to a prior reassessment on this point.

- The amount of the discrepancy between what should have been declared and what was declared, although significant, was not sufficient, on its own, to demonstrate voluntary fraud.

The court therefore annulled the 40% increase, pronouncing the total "discharge" of penalties.

It should be noted that this decision aligns with a recent precedent: that of the administrative court of appeal of Paris (January 31, 2025, No. 23PA02746).

What to Remember to Avoid Declaration Errors

Even though this decision is reassuring – as it shows that the absence of fraudulent intent can be recognized – it should not overshadow the following: a declaration error, even made in good faith, can be costly if not identified and rectified quickly. Here are some practical tips for startup managers and shareholders.

1. Know When the Allowance Applies (and When It Does Not)

- The holding period allowance only applies to IR.

- It does not apply to social contributions or CEHR.

- It does not apply if you opted for the flat tax (PFU), except in special cases (scale option).

Before any declaration of securities transfer, check which method of tax calculation you have chosen: IR scale or PFU.

2. Understand How to Fill Out Your Declaration

The complete tax treatment of the capital gain requires understanding the following boxes on your 2042-C declaration:

- Boxes 3VG / 3SG: to declare the net or gross capital gain according to its treatment.

- And, in certain special cases, annexes 2074 and 2042-C-PRO may be used.

The details are in the unique tax form (IFU), but its reading often remains unintuitive for non-specialists.

Do not hesitate to have your annual declaration reviewed by an accountant or tax lawyer familiar with entrepreneurial issues.

3. Keep Bank Justifications

In case of doubt or subsequent control, bank correspondence, IFUs, transfer statements, or capital gain calculation tables (as well as the acquisition history of the held securities) can be decisive. Their retention for a reasonable period (at least 6 years) is recommended.

4. Do Not Delay in Correcting an Error

It is better to submit a corrected declaration spontaneously than to discover an error during a control. A manifest error can be corrected by a rectifying declaration sent within the deadlines; this limits the risk of a fine and demonstrates your good faith.

An Increasingly Sensitive Topic: Taxation of Startup Founders

At PRAX Avocats, we frequently assist entrepreneurs who sell their company's securities, sometimes during a secondary fundraising or a buyout operation. These situations are increasingly monitored by the tax administration, especially when the gains are significant or when several advantageous tax mechanisms are combined (allowance, deferral, or suspension of taxation, etc.).

However, each situation is unique, especially for founders who have benefited from BSPCE or other equity compensation instruments. A simple declaration error, a misunderstanding about an allowance, or the incorrect treatment of a tax deferral can trigger a reassessment.

Our role is to anticipate, secure the planned arrangements, and ensure that the entire legal and tax framework is compliant, while remaining intelligible for those most concerned: the entrepreneurs themselves.

In Summary: Reassuring Jurisprudence, but Ongoing Vigilance Necessary

The decision of May 26, 2025, rendered by the administrative court of appeal of Versailles is a positive signal: it shows that the tax administration cannot automatically presume a deliberate intent to evade tax as long as the taxpayer has provided the necessary elements for verification.

But it especially reminds us of one thing: the taxation of capital gains on securities is complex and does not tolerate approximation.

Startup or innovative SME leaders must surround themselves with experts on this subject to anticipate the tax risks associated with a transfer. From the choice between PFU or progressive scale, to filling out boxes 3SG, 3VG, or managing a tax deferral, each step requires rigor and tailored support.

---

To secure your transfer projects, structure a shareholders' agreement, or anticipate the tax impact of your next fundraising, our firm supports you at every step.

👉 Contact PRAX Avocats for personalized legal support.